Why Broker Relationships Are the Hidden Scaling Constraint

“Distribution is king.”

Everyone in insurance says this. Few understand what it actually means.

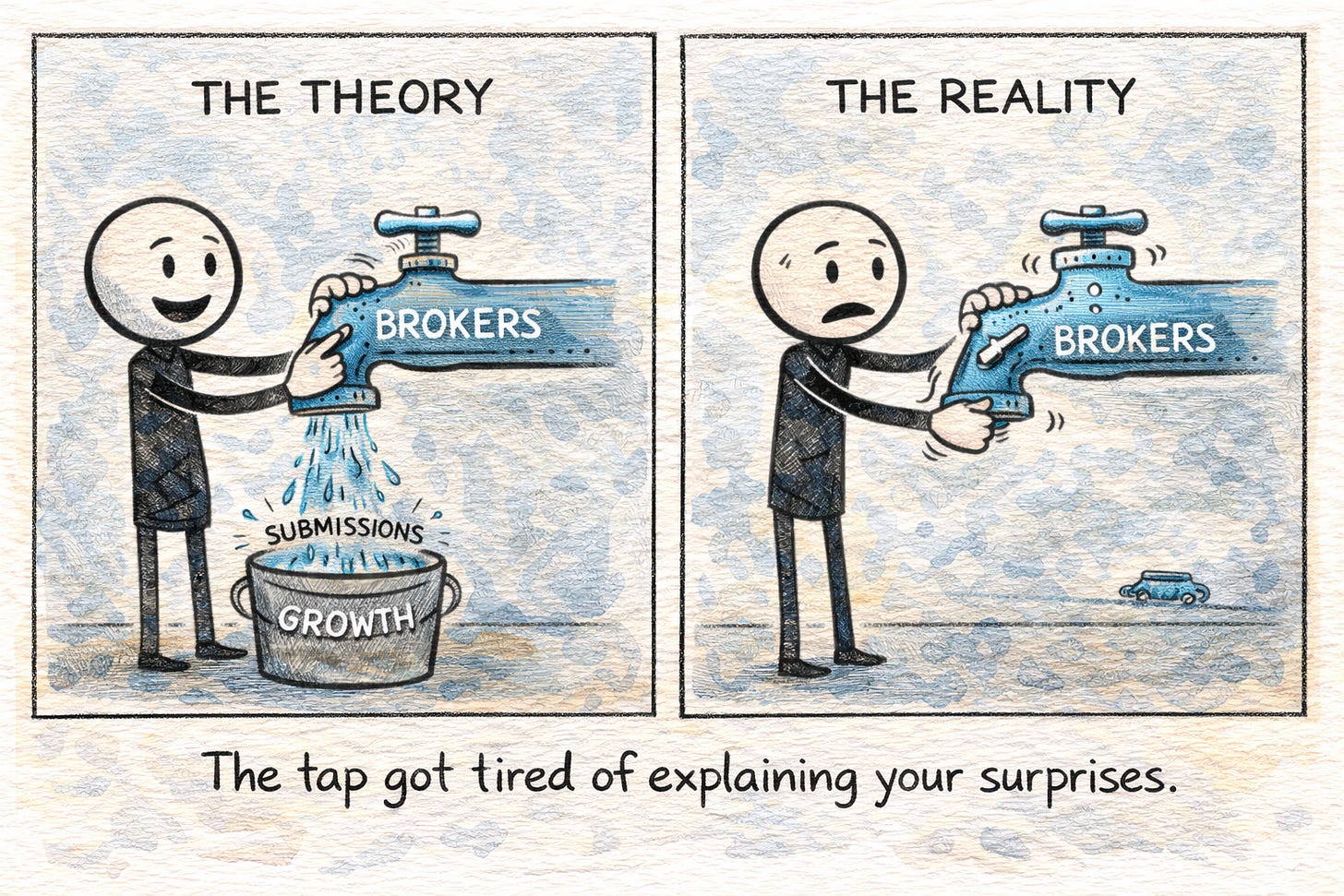

Distribution is treated like a tap you turn on. Brokers are treated like pipes. Volume is mistaken for trust.

This is why programs stall.

The problem isn’t that brokers won’t place business. The problem is that they won’t risk their reputation repeatedly for you. And if you don’t understand the difference, you’ll misdiagnose every growth plateau you hit.

Distribution doesn’t stall. Trust quietly withdraws.

Brokers Are Not Distribution

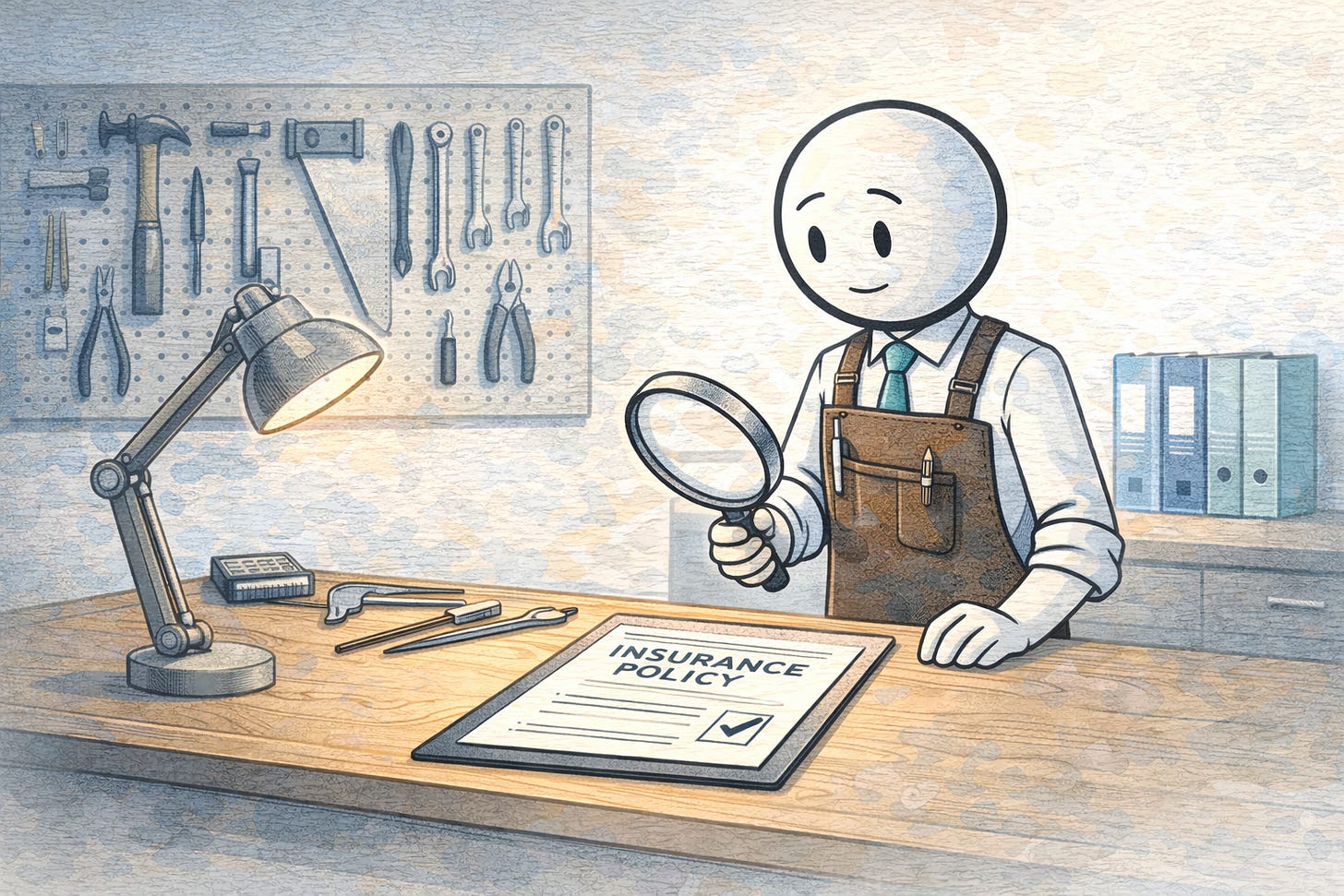

Brokers are risk translators.

They sit between insureds who need coverage, MGAs who want submissions, and carriers who have appetite—translating risk narratives across systems that don’t naturally speak to each other.

Every placement is a reputational act. When a broker recommends your program to a client, they’re not just moving paper. They’re making a claim about you. About your underwriting. Your service. Your reliability when things go wrong.

Every time a broker sends you business, they’re making a claim about you—not just your product.

If you perform, they look smart. If you don’t, they absorb the damage.

This is why unproven markets stay unproven. It’s not broker ignorance. It’s rational risk management. A broker’s entire business is their credibility with clients. They’re not going to spend it on a program that might embarrass them.

What Brokers Are Actually Optimizing For

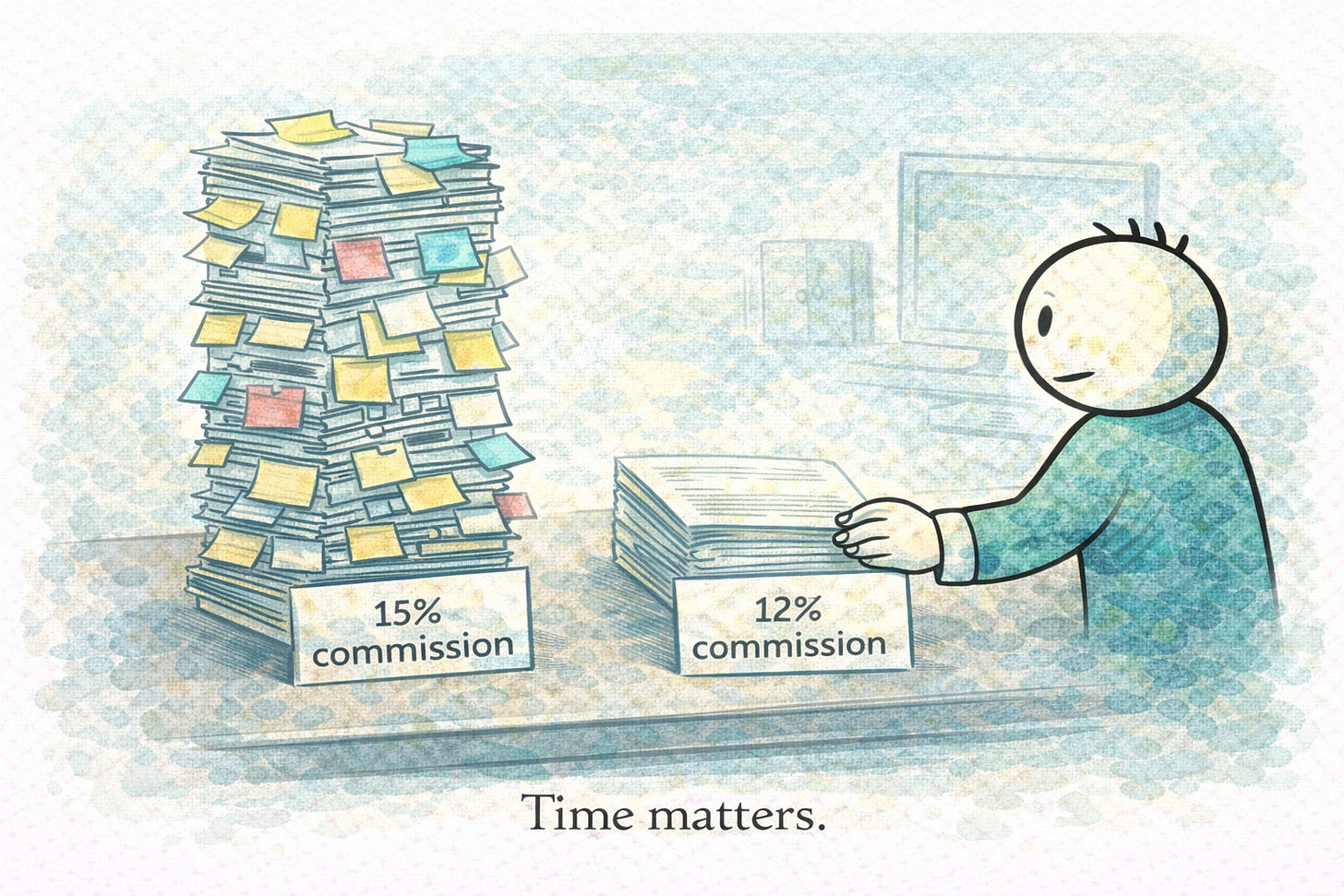

Not commission. Time-adjusted economics.

A 15% commission on a product that takes three times longer to quote, explain, and bind is worse than 12% on something that flows. Brokers have finite hours. Every program competes for that time against every other program—including the ones they already know how to sell.

The math isn’t “which product pays best.” The math is “which product pays best per unit of effort and reputational risk.”

A program that looks innovative but behaves erratically costs brokers more than it pays them—even at higher commissions. This is why “great products” sometimes don’t scale. The product might be great. The experience of selling it isn’t.

Brokers optimize for predictability, not excitement. If you want their sustained attention, you need to be easy to sell and safe to recommend. Those are operational requirements, not relationship requirements.

If a broker has to explain you, you’re already expensive.

The Boundary of Responsibility

Here’s the quiet truth brokers rarely say out loud:

They’re willing to translate risk. They’re not willing to own your operational failures.

Brokers expect to explain coverage nuance. They don’t expect to explain why underwriting changed its mind, why claims are stalled, or why appetite narrowed after the pitch.

When that line blurs, brokers don’t escalate. They disengage.

A broker can survive a tough declination if they saw it coming. They cannot survive looking like they didn’t know what they were selling. The difference between those two outcomes is entirely in your hands.

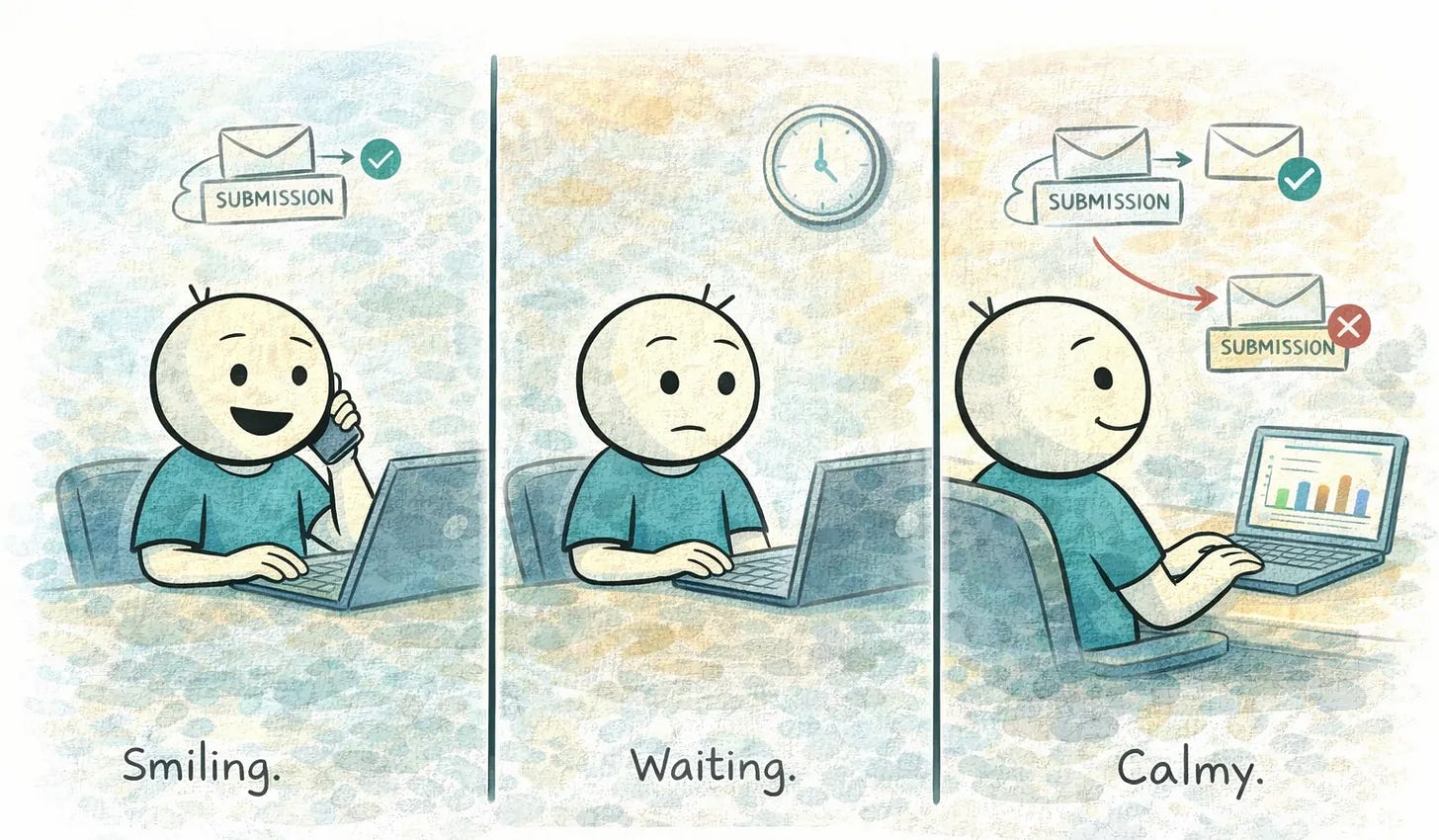

The Second Placement Test

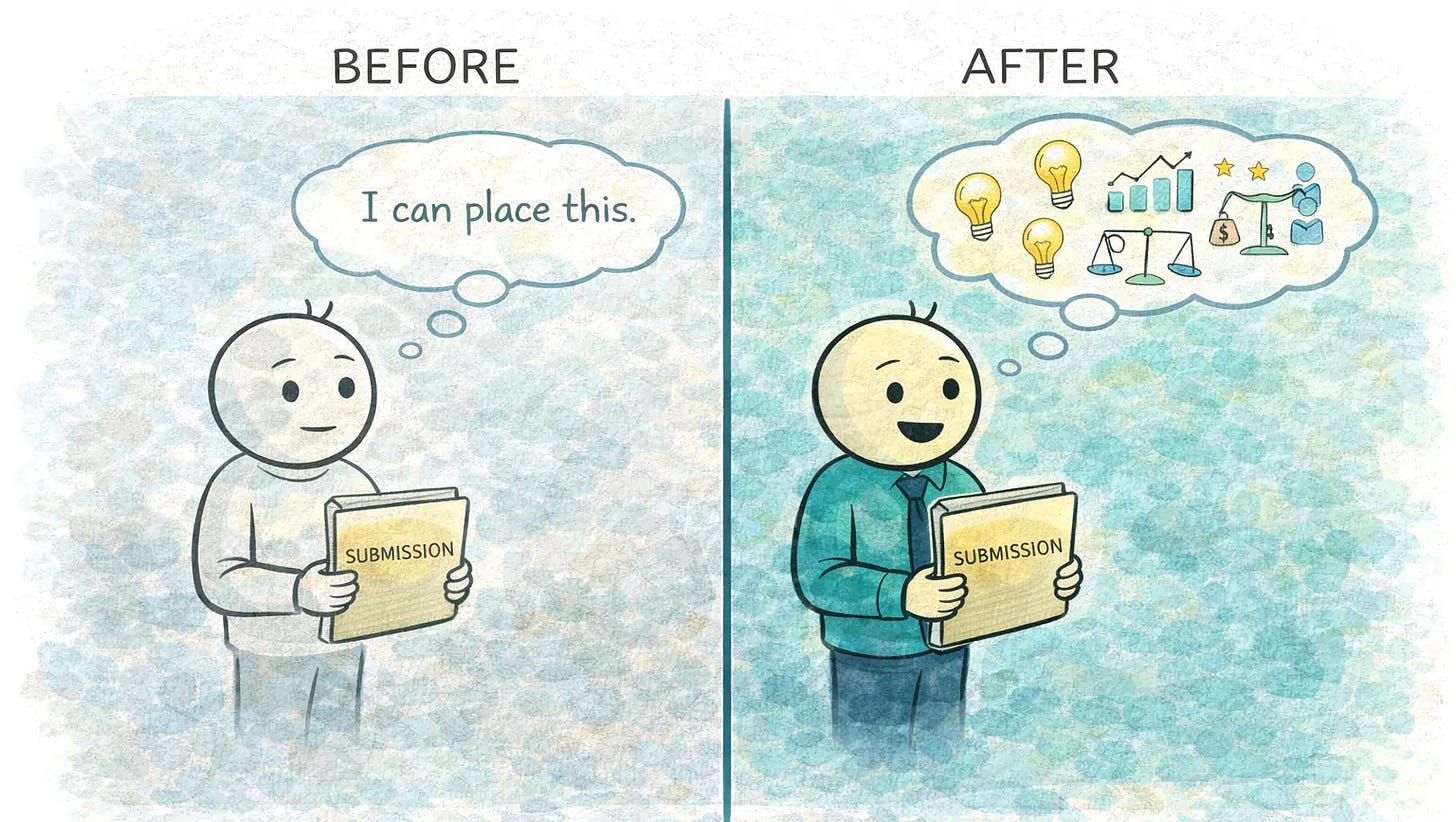

Most programs pass the first placement test.

The real filter is the second.

The first placement happens because the broker is curious. The appetite sounds interesting. The product fills a gap. They’re willing to try it.

The second placement happens only if the broker is confident. Confident it will bind the way they expect. Confident the service will match the pitch. Confident they won’t have to explain a surprise.

Programs don’t stall because brokers won’t try them. They stall because brokers won’t repeat them.

If you want to diagnose your broker health, don’t count how many brokers have sent you a submission. Count how many have sent you a second one.

Broker Fatigue Is a Trust Cost, Not an Effort Cost

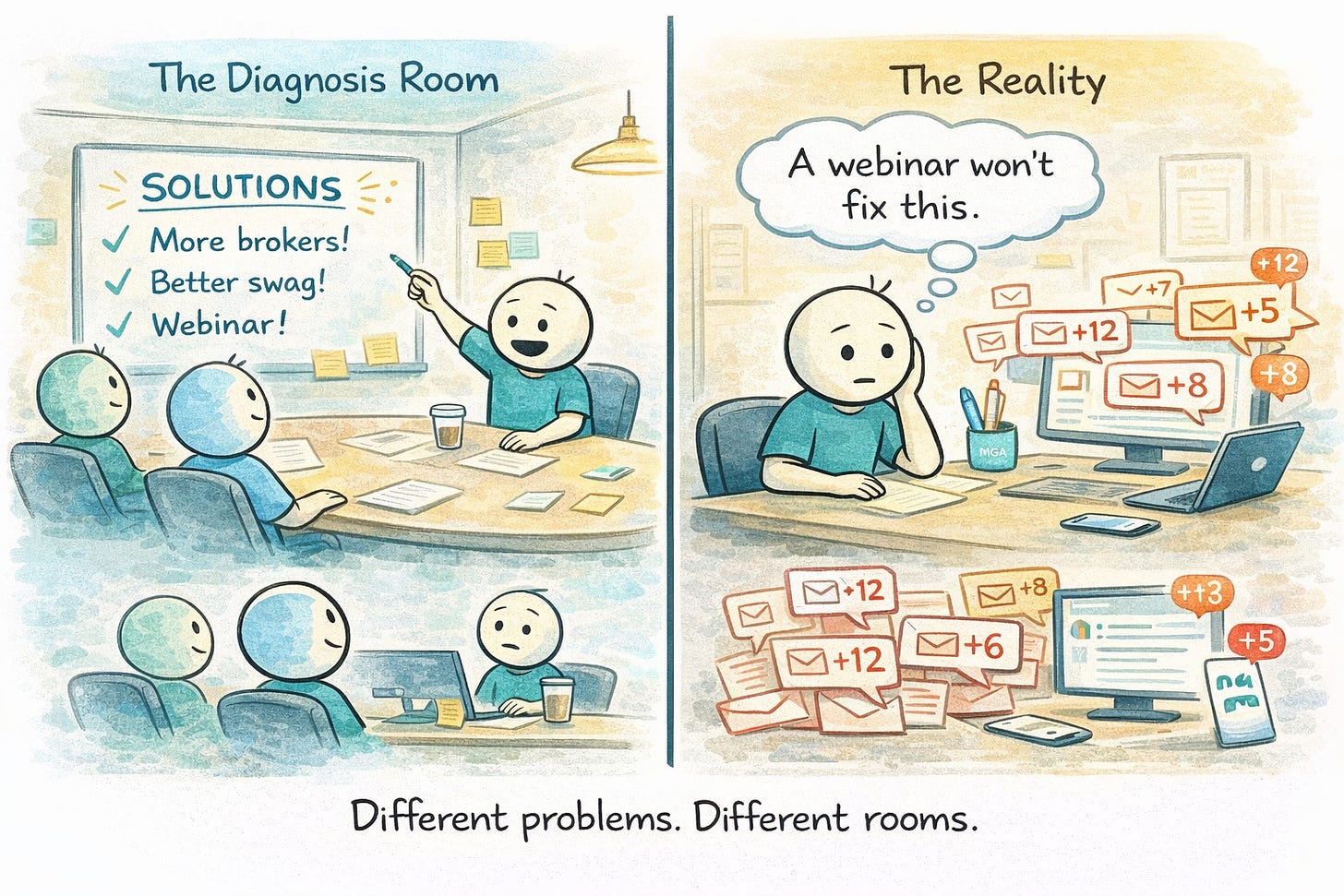

Most people misdiagnose broker fatigue. They assume it’s too many products to track, too much administrative burden, or not enough commission.

It’s none of those things.

Broker fatigue is the accumulation of credibility risk. It comes from inconsistent underwriting decisions, unexplained declinations, appetite changes communicated after brokers have already pitched, claims that don’t go smoothly, and problems that require the broker to explain something they didn’t cause.

Brokers don’t burn out from placing too much business. They burn out from explaining too many surprises.

Every surprise costs them. A declination they didn’t see coming means a difficult conversation with a client. A mid-term carrier pullback means they have to find new coverage and explain why. A slow claim means they’re fielding calls they shouldn’t have to field.

These costs are invisible to the MGA. They’re not invisible to the broker. And they accumulate.

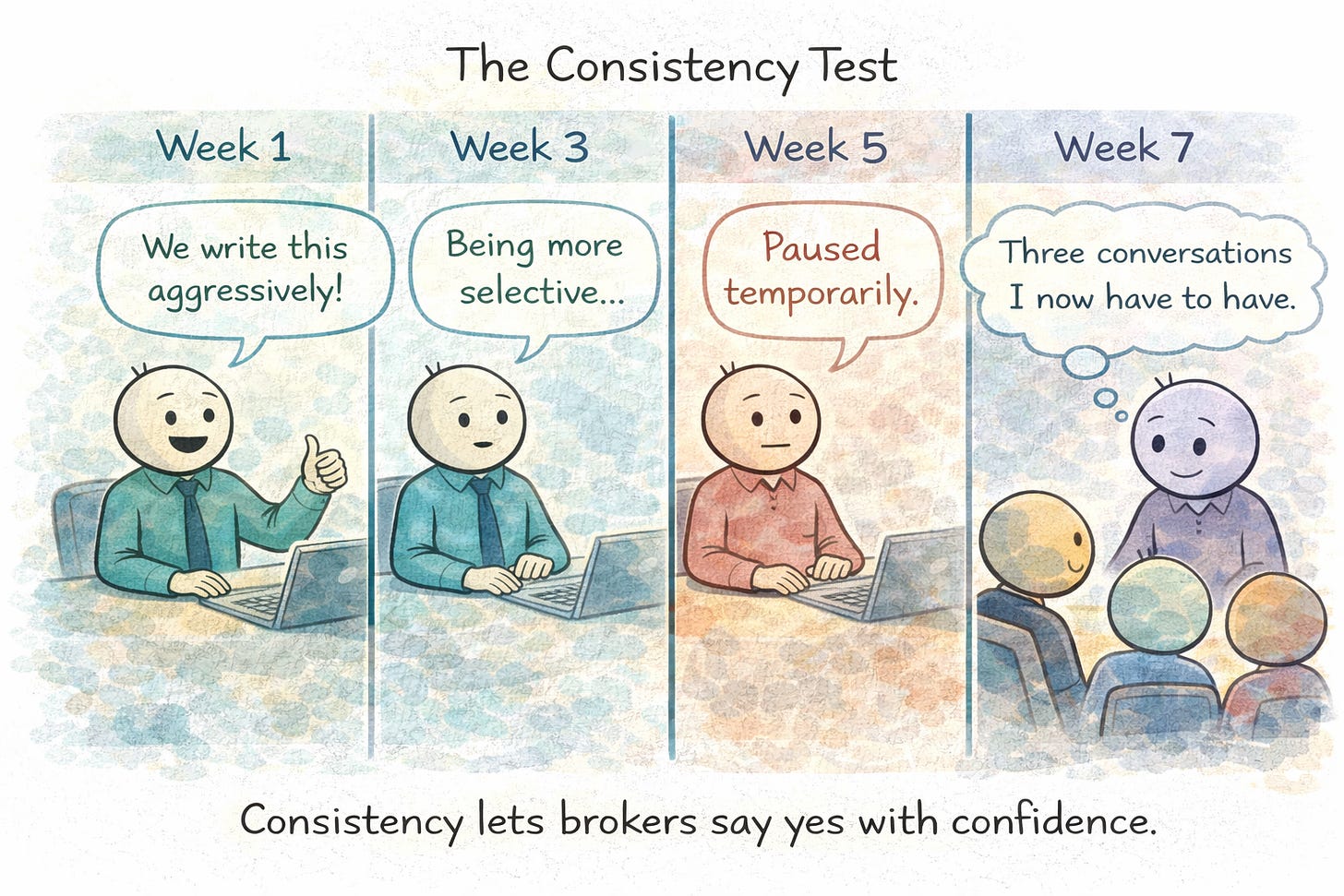

Broker-Friendly vs. Broker-Safe

Many programs confuse being broker-friendly with being broker-safe.

Friendly is answering the phone. Safe is behaving the same way every time.

Friendly is flexibility. Safe is predictability.

Friendly is “we’ll take a look at anything.” Safe is “here’s exactly what we write, and we write it consistently.”

Brokers appreciate friendliness. They scale on safety.

A program that’s responsive but erratic creates more work than one that’s slightly slower but predictable. Brokers can plan around consistent behavior. They can’t plan around surprises.

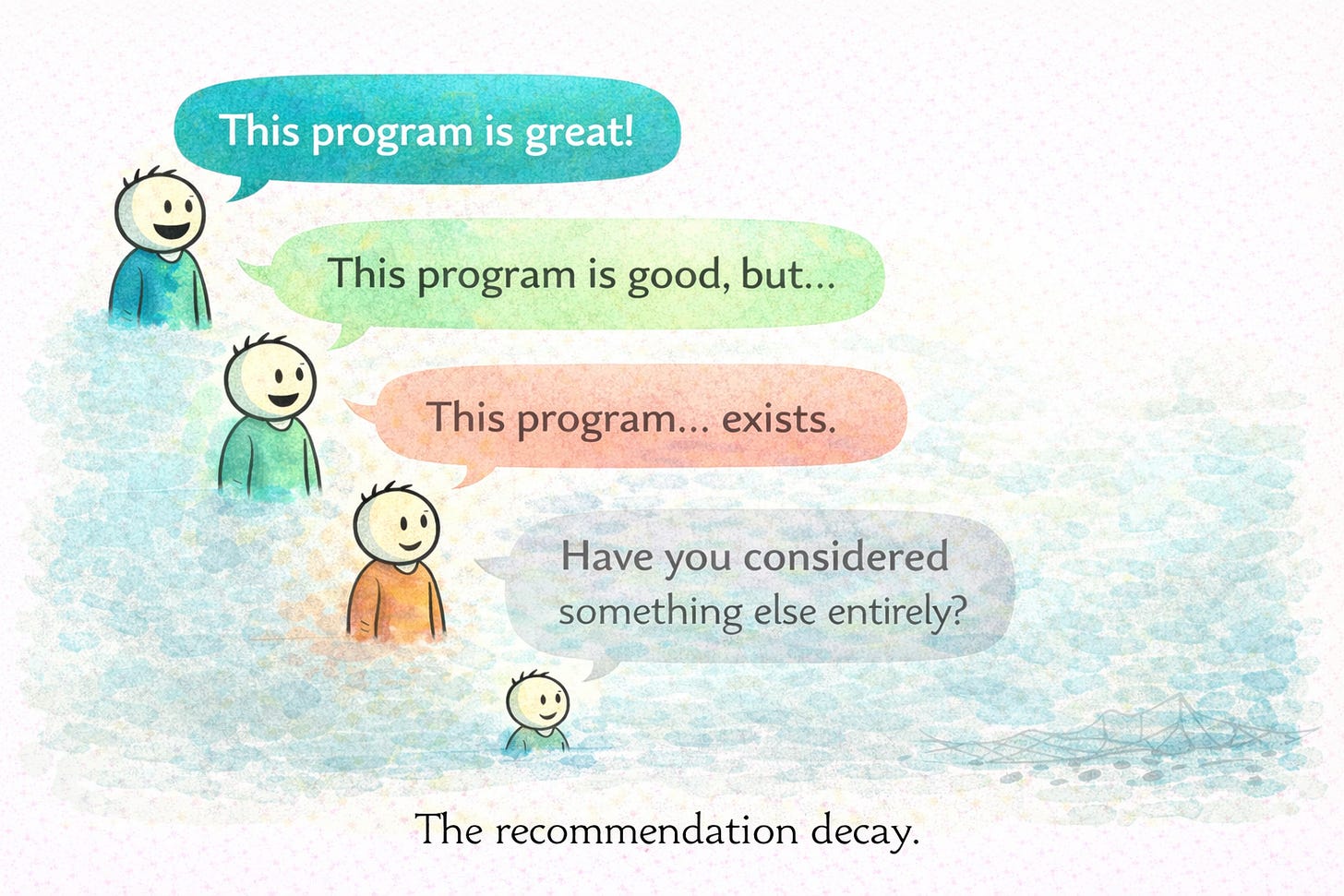

The Enthusiasm Decay Curve

Here’s the pattern no one talks about:

Programs launch with broker excitement. The product is new. The appetite is fresh. Early wins come quickly.

Then friction accumulates.

Submission requirements don’t match broker workflows. Underwriting takes longer than promised. A few claims don’t go smoothly. Appetite tightens without warning. A couple of renewals get non-renewed.

Enthusiasm fades.

Brokers don’t announce they’re done with you. They don’t send a breakup email. They just stop calling. Submissions slow. The best brokers—the ones with options—quietly redirect their business elsewhere. You’re left with the brokers who don’t have better alternatives.

Brokers don’t avoid new programs. They avoid new explanations.

By the time you notice, the decay is already advanced.

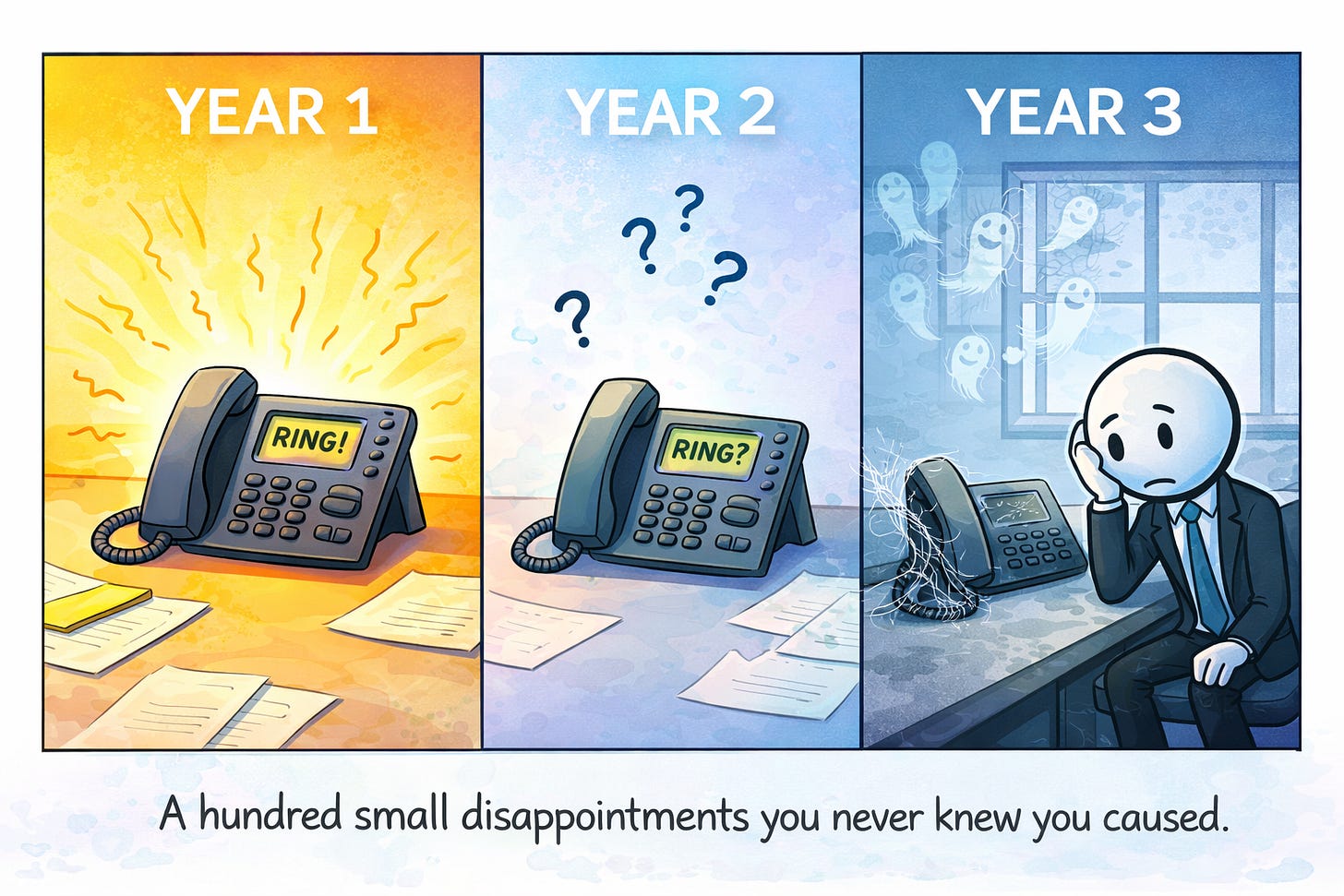

The Leading Indicators No One Tracks

Submissions are a lagging indicator. By the time volume drops, trust has been eroding for months.

Watch for: Quote requests that used to convert now “going another direction.” Brokers asking more questions before submitting—they’re pre-qualifying whether it’s worth spending credibility. Fewer referrals from existing broker relationships. More “just checking if you’d look at this” calls—they’re testing appetite before committing. The mix shifting toward harder-to-place risks.

Brokers rarely tell you they’ve lost confidence. They show it by changing which risks they send.

When you stop seeing their best accounts, that’s not a pipeline issue. It’s a trust signal. Brokers don’t punish programs loudly. They reallocate quietly.

These signals appear six to twelve months before the pipeline visibly shrinks. By the time submission volume drops, you’re not seeing early warning signs. You’re seeing consequences.

Brokers Talk to Each Other

The conversation you’re not in: Brokers talk. At conferences. In group chats. Over drinks after appointments.

When a program creates a surprise, it doesn’t stay between you and that broker. It becomes a story. “They changed appetite mid-bind.” “Claims took four months.” “I had to explain a declination I didn’t see coming.”

These stories spread faster than your marketing. By the time you notice submissions slowing from multiple brokers simultaneously, the reputation has already traveled.

You didn’t lose one broker. You lost the network.

This works in reverse too. Programs that consistently perform become the ones brokers recommend to each other. “They’re fast.” “They do what they say.” “I’ve never had a claims issue.” That reputation compounds just as quickly.

The Credibility Decay Loop

This is where programs die without understanding why.

It starts with success. Program scales fast. Volume increases. The team is stretched. Underwriting consistency slips. Response times lengthen. Small problems don’t get handled cleanly.

Brokers notice. They start caveating placements to clients: “This market is good, but...” They hedge their recommendations. They send you the business they can’t place elsewhere, not the business they’re excited about.

The best brokers—the ones with the best books—quietly stop sending deals. They don’t need the friction. They have other options.

The program compensates by widening the funnel. More broker relationships. Lower quality submissions. More time spent on business that doesn’t bind.

Carrier partners notice the mix shift. Loss ratios drift. Underwriting pressure increases. Appetite tightens.

Now brokers have another thing to explain to clients. More credibility spent. More fatigue accumulated.

The loop accelerates.

This is how programs go from “hot market” to “we stopped seeing submissions” in eighteen months. It’s not one thing. It’s a system.

The Market of Last Resort Trap

When trust erodes broadly, you don’t stop getting submissions entirely. You start getting different submissions.

The risks other markets declined. The accounts that have been shopped everywhere. The business brokers can only place with you because no one else will take it.

From the inside, this looks like “we’re still writing business.” From the outside, it looks like adverse selection.

Your loss ratio drifts. Carrier partners get nervous. You tighten appetite—which creates more surprises for the brokers still sending you business. The remaining trust erodes faster.

You didn’t become a bad program. You became the program brokers use when they’ve run out of options. That’s a different business model, and most MGAs don’t survive the transition.

Claims Is Where Trust Lives or Dies

Everything before the claim is a pitch. The claim is the product.

A broker can survive slow quotes. They can explain a declination. They cannot survive a client calling them asking why their claim hasn’t been acknowledged after three weeks.

One bad claims experience erases years of clean placements. Because the broker doesn’t remember the twenty deals that went fine. They remember the one where they had to apologize. And they remember it every time they consider sending you another.

Claims handling is the ultimate test of whether you’re broker-safe. It’s easy to be consistent when everything goes right. The question is what happens when it doesn’t.

The Carrier Sees This Too

When your submission quality declines—more hard-to-place risks, fewer clean accounts—carriers notice.

They might not say “your brokers are losing confidence.” They’ll say “the mix is shifting” or “we’re seeing adverse selection.” But the underlying signal is the same: the brokers with the best books have stopped sending you their best business.

Carriers read this as program health.

Eroding broker trust becomes eroding carrier trust. Two relationships decay in parallel, and by the time you’re addressing one, the other is already in motion.

Why Brokers Are the Fastest Scaling Engine You Have

It’s easy to read all of this as a warning about brokers. That’s not the point.

The point is that brokers are the most powerful accelerant an MGA can have—when the relationship works.

Brokers are closer to the customer than carriers will ever be. They see demand shift in real time. They hear objections before they show up in loss ratios. They know when appetite is real and when it’s theoretical.

And unlike carriers, brokers don’t need a steering committee to move.

When a broker trusts a program, they don’t “roll it out.” They just start using it.

That’s why programs don’t grow linearly through brokers. They grow in bursts. One office figures it out. Then another. Then a whole region quietly shifts behavior.

Carriers scale through committees. Brokers scale through habit.

Once a broker incorporates a program into their mental model—this risk goes here, this story lands well, this market behaves predictably—that habit compounds. But habit only forms when the program behaves consistently, doesn’t embarrass them, and doesn’t require re-explanation every time.

That’s not a broker problem. That’s a program design problem.

Brokers don’t slow programs down. They accelerate the ones they believe in—and abandon the rest quietly.

What Brokers Actually Want

Everything above describes what brokers protect against. But protection is only half the picture.

At the highest level, brokers are not optimizing for commission, convenience, or even safety. They are optimizing for agency.

The best brokers want to place hard risks that others can’t. They want to build differentiated books. They want to be known as experts, not intermediaries. They want to grow into trusted advisors, not order-takers.

They don’t just want to move risk. They want to shape it.

Elite brokers want to be the person clients call when the market says no.

That’s status. That’s identity. That’s professional pride. They want to say: “I know a market for this.” “I’ve seen this risk before.” “This is tricky, but we can solve it.”

MGAs are supposed to be the tool that enables that version of the broker.

Two Kinds of Broker Energy

This distinction matters more than most MGAs realize.

Transactional energy is finite. It’s what brokers spend on placing standard risks, optimizing for speed, minimizing explanation, avoiding surprises. This is where friction kills you. Every extra step, every inconsistency, every surprise depletes this pool.

Aspirational energy is powerful. It’s what brokers bring to solving edge cases, building a specialty, growing a differentiated book, becoming “the broker who knows.” This is where brokers will lean in—if you don’t embarrass them.

Brokers will spend credibility willingly—even aggressively—when it helps them become who they want to be. They’ll take risks on new programs, novel structures, and emerging capacity if the upside is professional differentiation.

But they will not do it repeatedly, unpredictably, or without institutional support.

That’s the line.

MGAs that scale tap both: low-friction flows for the core, high-trust collaboration for the edge. Most MGAs only design for the first and accidentally destroy the second.

The Tragic Failure Mode

The tragedy is that MGAs are supposed to help brokers self-actualize—and often end up infantilizing them instead.

What that looks like in practice: opaque underwriting decisions, appetite that shifts without explanation, claims behavior that contradicts the sales story, treating brokers like submission machines instead of partners.

This doesn’t just slow growth. It kills enthusiasm.

Brokers don’t disengage because they’re tired. They disengage because the work stops being meaningful. When every placement feels like a transaction instead of an act of professional judgment, the best brokers find programs that treat them differently.

The best brokers don’t want less responsibility. They want responsibility they can stand behind.

What Scaling Programs Do Differently

The programs that actually scale treat broker trust like a non-renewable resource.

They don’t just accept risk. They accept responsibility for the broker’s reputation.

Concretely, this means:

They make brokers look good in front of clients. Fast quotes. Clear declinations with reasons. No surprises at bind. When something goes wrong, they fix it before the broker has to explain it.

They behave consistently, even when capacity tightens. Appetite changes get communicated before brokers pitch business that won’t get written. Underwriting criteria don’t shift week to week. A broker can recommend the program with confidence because it behaves the way it said it would.

They reduce friction to near-zero. Submission requirements match how brokers actually work. Turnaround times are predictable. The technology doesn’t create extra steps. The broker’s time investment is respected.

They protect brokers from downstream embarrassment. Claims get handled well. Renewals don’t surprise anyone. When problems happen—and they will—the program owns them instead of making the broker own them.

They help brokers become better at their craft. They let brokers win professionally, not just economically. They help them tell a smarter story to clients. They give them confidence to say yes to harder risks.

The easiest program to sell wins—even if it’s not the best one. But the programs that become default markets are the ones that make brokers better.

This isn’t relationship management. It’s operations plus aspiration. The best broker strategy protects the floor and raises the ceiling.

Acquisition vs. Retention

When growth stalls, the instinct is to find new brokers. More relationships. Wider funnel.

But new brokers don’t know your patterns yet—they’re taking a credibility risk on an unproven program. The bar is higher. Meanwhile, existing brokers who already trusted you are quietly leaving.

Replacing a broker who knew your quirks and worked with you anyway with a new broker who has no such patience is a net loss.

Retention is cheaper than acquisition in broker relationships, just like everywhere else. But no one measures it.

Before you spend resources finding new brokers, ask whether you’re keeping the ones you have. If not, new relationships will follow the same decay curve.

Rebuilding Once Trust Has Eroded

If you’ve already damaged broker relationships, the path back isn’t “more outreach.” It’s demonstrated change over time.

Brokers who’ve been burned don’t believe promises. They believe patterns.

You rebuild by: Fixing the operational issues that caused the surprises—visibly. Over-communicating for a sustained period—appetite changes announced weeks early, not days. Taking responsibility for past friction without being asked. Giving brokers a reason to test you again with low-stakes placements. And then not screwing those up.

The timeline is eighteen to twenty-four months of consistent behavior before trust meaningfully returns. There’s no shortcut. The same brokers who reallocate quickly when trust erodes reallocate slowly when you’re trying to earn it back.

That asymmetry is the cost of having damaged the relationship in the first place.

Why This Matters Now

As underwriting tightens, audits increase, and carrier tolerance narrows, broker credibility becomes even more valuable.

In soft markets, friction is forgiven. In hard markets, it’s remembered.

The next wave of scaling programs won’t win by shouting louder. They’ll win by being easier to stand behind—and by helping brokers become the professionals they want to be.

The Point

Your growth ceiling is probably not demand. It’s probably not capacity. It’s probably not product.

It’s broker trust dynamics you’re unintentionally eroding.

Every time you ask a broker to recommend you, you’re asking them to spend credibility. If you’re not earning that credibility back—through consistency, through service, through making their job easier—you’re drawing down an account that doesn’t refill automatically.

But credibility protection is only half the equation. The programs that truly scale don’t just avoid embarrassing brokers. They elevate them. They help brokers become the person clients call when the market says no.

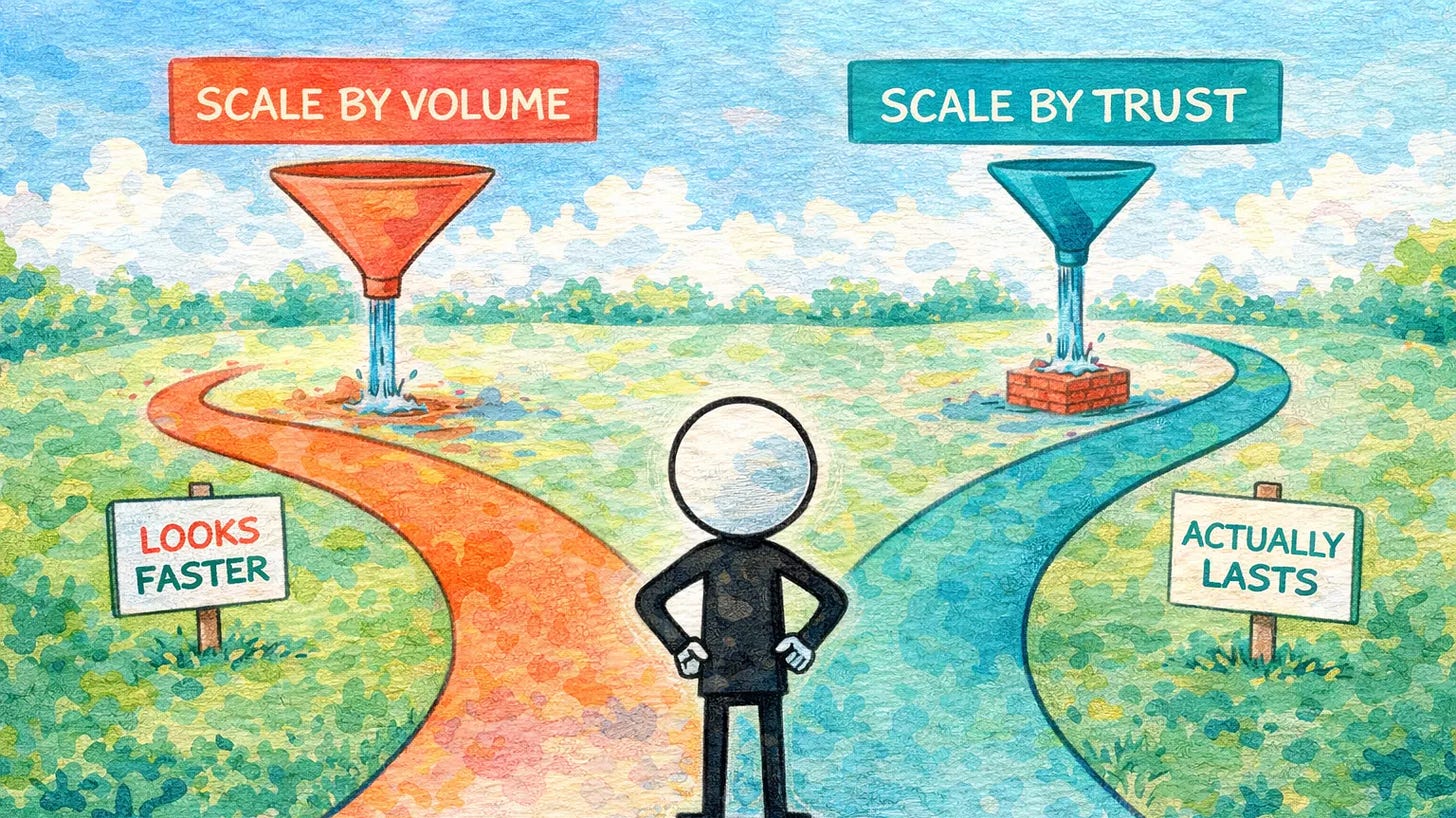

You can scale by volume or you can scale by trust.

Volume looks faster. Trust actually lasts.

If your growth model requires brokers to keep spending credibility on your behalf, you’d better be investing in earning it back. And if you want brokers to champion you—not just tolerate you—you’d better be helping them become who they want to be.

Otherwise, you’ll wake up one day wondering why the phones stopped ringing—and the answer will be a hundred small disappointments you never knew you caused, plus one big missed opportunity you never saw.

The framing around broker-safe versus broker-friendly is sharp. Most programs optimize for responsivenss when they should be optimizing for predictability - brokers can work around slow, they cant work around erratic. I've watched MGAs spend thousands on broker events and relationship-building while their underwriting consistency was actively burning credibility they didnt even know they had. The bit about measuring second placements instead of first ones is dunno probably the clearest diagnostic for whether trust is actually forming or just curiosity testing.